1. Understand the Basics of Investing

Before diving into the world of stocks, bonds, and mutual funds, it's important to understand what investing actually means. Simply put, investing involves putting your money into assets that you believe will appreciate over time, generating returns such as dividends, interest, or capital gains.

Key Investment Types:

- Stocks: Buying shares in a company, giving you ownership and a chance to benefit from its growth.

- Bonds: Lending money to a government or corporation in exchange for regular interest payments.

- Mutual Funds: Pooled investments from many investors that are managed by professionals, often offering diversified portfolios.

- ETFs (Exchange-Traded Funds): Like mutual funds but traded on the stock exchange, often at a lower cost.

Having a basic understanding of these asset classes will help you make informed decisions about where to invest your money.

2. Define Your Investment Goals

Before making any investment, it’s important to determine your goals. Are you investing for long-term growth, like retirement, or do you need short-term gains for something like a vacation or home purchase?

Your goals will help shape your investment strategy. Long-term investments, like retirement funds, may focus on riskier assets such as stocks, while short-term investments may prioritize safer options, like bonds or certificates of deposit (CDs).

Risk Tolerance:

Assess your willingness to accept risk. Higher returns often come with greater risk. Understanding your comfort level with risk will guide your asset allocation and investment choices.

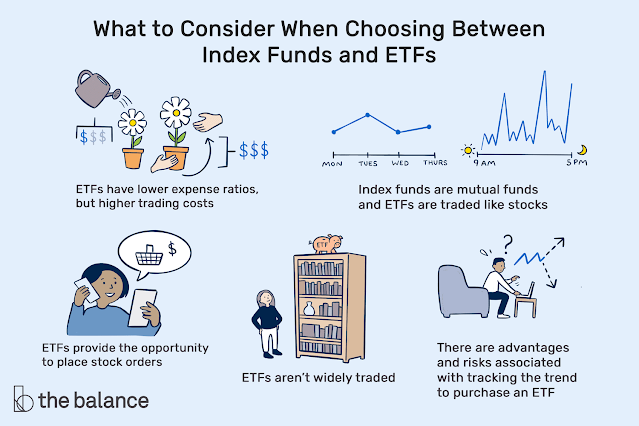

3. Start with Low-Cost Index Funds or ETFs

For beginners, low-cost index funds or ETFs are a great starting point. These investment vehicles track the performance of a specific market index, like the S&P 500. They offer several advantages:

- Diversification: By investing in an index fund or ETF, you are automatically investing in a broad range of companies or sectors, which helps spread risk.

- Low Fees: These funds have relatively low management fees compared to actively managed mutual funds, meaning more of your money stays invested.

- Simplicity: Index funds and ETFs are easy to buy and manage, especially for beginners.

For most new investors, starting with these types of funds is a smart, low-risk approach to building a diversified portfolio.

4. The Power of Compound Interest

One of the most important concepts in investing is compound interest. This is the process where the interest earned on your investments starts earning interest itself. Over time, compound interest can lead to significant growth in your portfolio.

The earlier you start investing, the more time your investments have to grow through compounding. Even small amounts invested regularly can snowball over time, making it one of the most powerful tools in investing.

5. Avoid Common Mistakes

While investing can be profitable, there are common mistakes that beginners often make. Being aware of these pitfalls can help you avoid losing money and ensure you’re on the right track.

- Timing the Market: Many beginners try to time the market by buying low and selling high, but this is often very difficult to do successfully. Instead, focus on a long-term strategy.

- Chasing Hot Tips: Be wary of following tips from unreliable sources or attempting to jump on the latest “hot stock.” These can lead to impulsive decisions and unnecessary losses.

- Overreacting to Market Volatility: The market will have ups and downs. Panicking during a downturn and selling off investments can lock in losses. Stay patient and stick to your plan.

6. Stay Consistent and Be Patient

Investing is not a get-rich-quick scheme. The key to success lies in consistency and patience. Regularly contribute to your investment account, even in small amounts, and give your investments time to grow. The longer you invest, the more opportunities you have to ride out any market fluctuations and benefit from compounding returns.

Conclusion

Investing can seem daunting at first, but with the right knowledge and approach, it can be one of the best decisions you make for your financial future. Start by understanding the basics, defining your goals, and choosing low-cost, diversified investments like index funds or ETFs. Avoid common mistakes like trying to time the market and overreacting to volatility. Above all, be patient and consistent, and watch your investments grow over time.